The Christian Solution

January 2019 AD

Blessed and Cursed

by Jews

is President Trump

Before we rip this New York Times article completely to shreds, let's look at the big picture for a moment.

The big picture is that:

And in that big picture comes President Trump's father who was famous among Jews in New York City for providing respectable homes for their fellow homeless European Jews washing up on our shores after WW2. For that Fred Trump was blessed by the Jews and so was his son Donald. As these homeless European Jews became established and rose in society, especially in regards to Manhattan where they pushed aside the old WASP Wall Street financial establishment and made it over in their their Jewish image, the Trumps were remembered when time came to build new skyscrapers in the city. Donald Trump was amply rewarded with real estate deals for his father's work.

Later Mark Burnett was allowed by Jewish media moguls from New York City to cast Donald Trump in his new series The Aprrentice, which turned the name Donald Trump into a household name. Don't get me wrong. Mark Burnett was born to a Roman Catholic father and a Presbyterian mother. He became head of MGM by pushing through a series of Survival shows which made his Jewish masters a whole boat load of money. Burnett first became known for Eco-Challenge where teams of people survived a race around the world. Then the series Survival, where teams survived the wilderness. The Apprentice is an urban corporate Survival. The Voice and The Contender were Survival shows in the entertainment industry, Shark Tank was Survival in the start-up business. But the point is that above the level of Mark Burnett were always Jewish paymasters and they were never afraid they were creating a national monster who would one day be against Jewish self-interest.

America's self interest has been Jewish self interest for the last 100 years, so Trump would not have been allowed to challenge that Jewish self-interest if they believed they could not trust him, or believed they could not easily take him down if the need ever arose. The powerful Jewish elites trusted their own New York City favorite son.

Now since he has exceeded his usefulness, the time to take down Donald Trump has arrived.

Before we get started, their's that nagging question again. Is this New York Times article being presented as a true hit piece intended to take down our President, or is it still a Bad Cop psy-ops article fraud? Jews can read between the lines just as well as you and I to see that the Trumps really helped immigrant Jews establish themselves here in America, while the article is writing actual lines to make the Trumps appear to be criminals to people who are incapable of reading between lines.

Yes, strangely, President Trump is both blessed by Jews and cursed by Jews.

If you are prized New York Times reporters such as Russ Buettner and Susanne Craig purport themselves to be, looking to publish a litany of "dirty trash" on the Trumps, one would assume they should not allow others the opportunity to rename the company they work for as the New York Slimes, as they so openly invite, by degrading the integrity of their work by appearing to lie about the last photo in the cumulation of your article "As the Trumps Dodges Taxes, Their Tenants Paid a Price."

Angel Castillo is pictured in the article moving out of his Beach Haven unit after the "current landlords" raised his rent by $150 a month.

All true, but all misdirection and fraud.

The article is outright fraudulent in coming to the climax of the article by spending the last three paragraphs talking about a totally irrelevant person. A man who rented the unit after the Trumps sold out, coupled with news on the current landlords raising rents who are not associated with the Trumps in any way.

Guilt by association much?

Not that the article starts off any better.

The prime photo shows Jack Leitner standing outside the Beach Haven apartments with subtitle stating he was defrauded by the Trumps.

This is a truly astounding statement to make when the reporters also report that Mr. Jack Leithner was a resident for over 20 years. Most apartment contracts I've ever seen are at worst one year contracts, which allows you the opportunity to move every year. Jack Leitner had the opportunity to find himself a better apartment 20 times and 20 times Jack Leitner felt that Trump Apartments were a better deal than any other he could find.

One could almost say that what prompted Jack Leithner to "complain" now has more to do with politics since Trump became President than with any issues in the rent payments.

Same story with Susan Shavitz. Decades later, she now has a beef with the beef she's been eating for decades.

The reason both Jews, Jack and Susan, stayed is clearly stated in the article. The article does not point out the other side of the coin. The Trumps kept out blacks and mostly rented to fellow Jews Jack and Susan could relate with. Of course these Jews were racist Jews who were more than happy for the Trumps to keep out the riff-raff.

Woody Guthrie was at least honest enough to know that his nice place was kept nice through racist discrimination in favor of Jews and against blacks.

Decades of satisfied customers later, we are now in the Trump era where all logic is allowed to be thrown out the door, as was attempted in the Kananaugh Supreme Court hearings where all Statute of Limitations laws were thrown out the door as allegations going back to high school were dredged up, and presented fraudulently I may add.

For instance, regulations in New York City allow for a 4-year Statute of Limitations. "Except when fraud occurs", say the oracles of the New York Supreme Court? If the rent increases were perfectly legal, then there would be no basis for any challenge to rent increases. By the nature of the deal, the rent increases would have to be alleged to be fraudulent increase for a hearing to be convened. No sorry, if you were cheated in any way, you only had 4 years to complain, as stated in the law!!! If you have lived there for decades paying rent, year after year after year, you no longer have a right to complain about the rent.

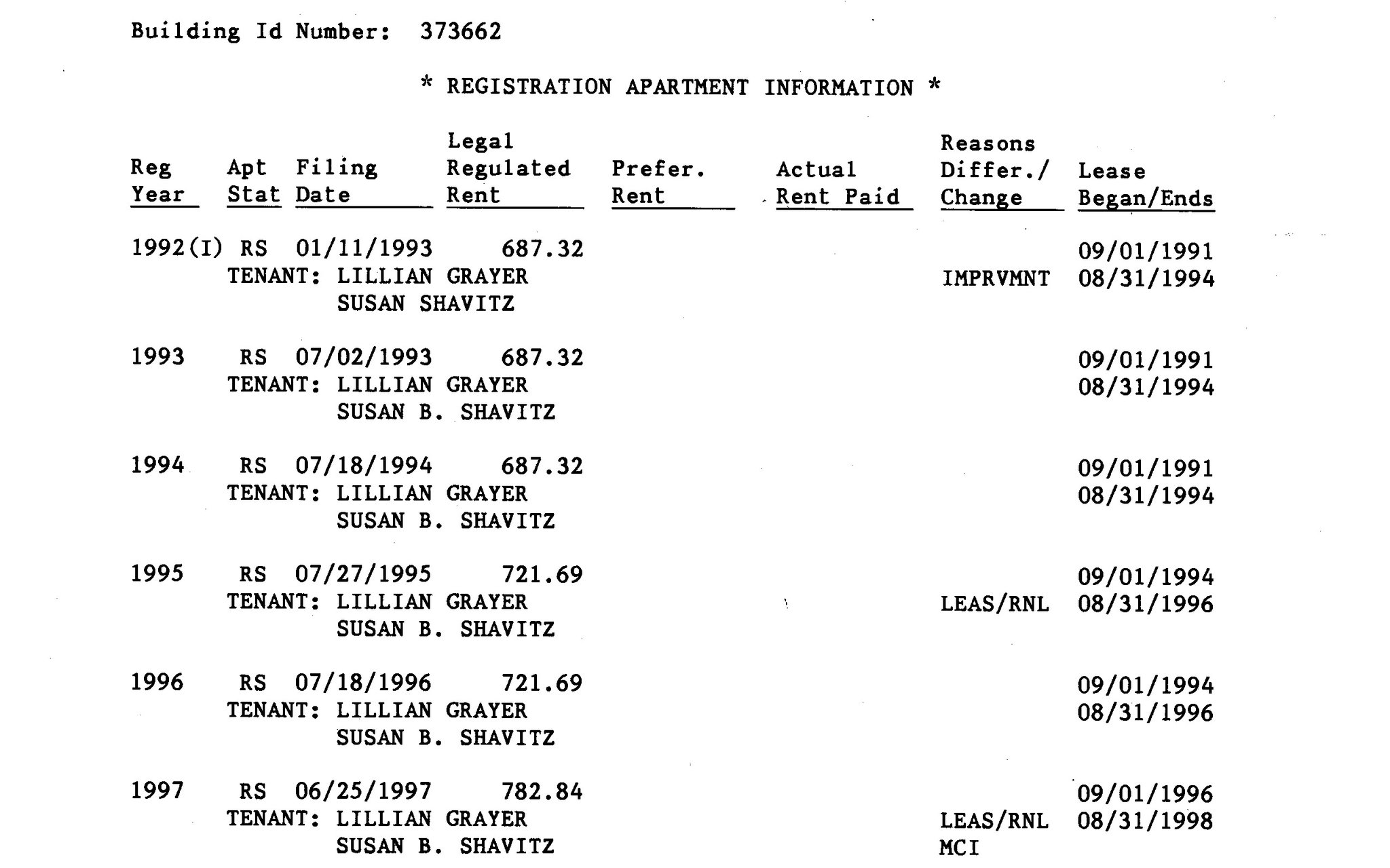

How much did the evil Satanic Trumps take their tenants for? In the case of Susan Shavitz, a measly 11% over 8 years (all attributed to improvements to her apartment complex by the way.)

Don't you know Jewish ingratitude for these improvements though is so great that that Jewess Shavitz is all in on doing a shakedown on President Trump and his family.

Article located at:

http://www.thechristiansolution.com/doc2019/907_FredTrump.html

by Jews

is President Trump

Before we rip this New York Times article completely to shreds, let's look at the big picture for a moment.

The big picture is that:

Jews may (but may not) bless you for blessing their tribe,

Jews will certainly curse you for cursing their tribe,

but know that both cases ride on what furthers the cause of Jews.

Jews will certainly curse you for cursing their tribe,

but know that both cases ride on what furthers the cause of Jews.

And in that big picture comes President Trump's father who was famous among Jews in New York City for providing respectable homes for their fellow homeless European Jews washing up on our shores after WW2. For that Fred Trump was blessed by the Jews and so was his son Donald. As these homeless European Jews became established and rose in society, especially in regards to Manhattan where they pushed aside the old WASP Wall Street financial establishment and made it over in their their Jewish image, the Trumps were remembered when time came to build new skyscrapers in the city. Donald Trump was amply rewarded with real estate deals for his father's work.

Later Mark Burnett was allowed by Jewish media moguls from New York City to cast Donald Trump in his new series The Aprrentice, which turned the name Donald Trump into a household name. Don't get me wrong. Mark Burnett was born to a Roman Catholic father and a Presbyterian mother. He became head of MGM by pushing through a series of Survival shows which made his Jewish masters a whole boat load of money. Burnett first became known for Eco-Challenge where teams of people survived a race around the world. Then the series Survival, where teams survived the wilderness. The Apprentice is an urban corporate Survival. The Voice and The Contender were Survival shows in the entertainment industry, Shark Tank was Survival in the start-up business. But the point is that above the level of Mark Burnett were always Jewish paymasters and they were never afraid they were creating a national monster who would one day be against Jewish self-interest.

America's self interest has been Jewish self interest for the last 100 years, so Trump would not have been allowed to challenge that Jewish self-interest if they believed they could not trust him, or believed they could not easily take him down if the need ever arose. The powerful Jewish elites trusted their own New York City favorite son.

Now since he has exceeded his usefulness, the time to take down Donald Trump has arrived.

Before we get started, their's that nagging question again. Is this New York Times article being presented as a true hit piece intended to take down our President, or is it still a Bad Cop psy-ops article fraud? Jews can read between the lines just as well as you and I to see that the Trumps really helped immigrant Jews establish themselves here in America, while the article is writing actual lines to make the Trumps appear to be criminals to people who are incapable of reading between lines.

Yes, strangely, President Trump is both blessed by Jews and cursed by Jews.

New York Times attack on President Trump

If you are prized New York Times reporters such as Russ Buettner and Susanne Craig purport themselves to be, looking to publish a litany of "dirty trash" on the Trumps, one would assume they should not allow others the opportunity to rename the company they work for as the New York Slimes, as they so openly invite, by degrading the integrity of their work by appearing to lie about the last photo in the cumulation of your article "As the Trumps Dodges Taxes, Their Tenants Paid a Price."

Angel Castillo is pictured in the article moving out of his Beach Haven unit after the "current landlords" raised his rent by $150 a month.

All true, but all misdirection and fraud.

The article is outright fraudulent in coming to the climax of the article by spending the last three paragraphs talking about a totally irrelevant person. A man who rented the unit after the Trumps sold out, coupled with news on the current landlords raising rents who are not associated with the Trumps in any way.

Guilt by association much?

Not that the article starts off any better.

The prime photo shows Jack Leitner standing outside the Beach Haven apartments with subtitle stating he was defrauded by the Trumps.

This is a truly astounding statement to make when the reporters also report that Mr. Jack Leithner was a resident for over 20 years. Most apartment contracts I've ever seen are at worst one year contracts, which allows you the opportunity to move every year. Jack Leitner had the opportunity to find himself a better apartment 20 times and 20 times Jack Leitner felt that Trump Apartments were a better deal than any other he could find.

“I’ve

always thought there was something strange going on,” said Jack

Leitner, who has lived in the Beach Haven Apartments in Coney Island,

Brooklyn, for more than two decades. “But you have to have proof, and

it’s an uphill battle.”

One could almost say that what prompted Jack Leithner to "complain" now has more to do with politics since Trump became President than with any issues in the rent payments.

Same story with Susan Shavitz. Decades later, she now has a beef with the beef she's been eating for decades.

Susan

Shavitz, 73, moved into her two-bedroom at Trump Village in Coney

Island with her mother when Fred Trump completed construction in 1964.

Decades later, her rent begin to rise more quickly.

The reason both Jews, Jack and Susan, stayed is clearly stated in the article. The article does not point out the other side of the coin. The Trumps kept out blacks and mostly rented to fellow Jews Jack and Susan could relate with. Of course these Jews were racist Jews who were more than happy for the Trumps to keep out the riff-raff.

Like

Ms. Shavitz and her mother, thousands of tenants once saw moving into a

Fred Trump building as a step up the economic ladder, an arrival of

sorts.

In the postwar era, the president’s father came to own more than 10,000 apartments in New York City, and thousands more elsewhere, often financing the construction through low-interest government loans aimed at creating affordable housing for returning veterans and the booming middle class.

The rules attached to those loans kept rents low, but Fred Trump excelled at keeping costs low, and the empire became enormously profitable.

In the postwar era, the president’s father came to own more than 10,000 apartments in New York City, and thousands more elsewhere, often financing the construction through low-interest government loans aimed at creating affordable housing for returning veterans and the booming middle class.

The rules attached to those loans kept rents low, but Fred Trump excelled at keeping costs low, and the empire became enormously profitable.

Woody Guthrie was at least honest enough to know that his nice place was kept nice through racist discrimination in favor of Jews and against blacks.

The

folk singer Woody Guthrie took an apartment at Beach Haven in 1950. He

wrote a song called “Old Man Trump,” contemplating the morality of

paying rent to someone who would not allow blacks to live in the

building.

Decades of satisfied customers later, we are now in the Trump era where all logic is allowed to be thrown out the door, as was attempted in the Kananaugh Supreme Court hearings where all Statute of Limitations laws were thrown out the door as allegations going back to high school were dredged up, and presented fraudulently I may add.

For instance, regulations in New York City allow for a 4-year Statute of Limitations. "Except when fraud occurs", say the oracles of the New York Supreme Court? If the rent increases were perfectly legal, then there would be no basis for any challenge to rent increases. By the nature of the deal, the rent increases would have to be alleged to be fraudulent increase for a hearing to be convened. No sorry, if you were cheated in any way, you only had 4 years to complain, as stated in the law!!! If you have lived there for decades paying rent, year after year after year, you no longer have a right to complain about the rent.

Regulations

generally allow tenants to challenge rent for the past four years. But

the state’s highest court has held that tenants can look back further

to show their landlord increased rent through fraud (though damages are

still limited).

How much did the evil Satanic Trumps take their tenants for? In the case of Susan Shavitz, a measly 11% over 8 years (all attributed to improvements to her apartment complex by the way.)

While

it is not known how much of that is attributable to All County, the

cost of improvements bumped up her rent in five of the last eight years

that the Trumps owned the buildings, adding 11 percent in all.

Don't you know Jewish ingratitude for these improvements though is so great that that Jewess Shavitz is all in on doing a shakedown on President Trump and his family.

Ms.

Shavitz said that she was financially comfortable and could afford her

rent but would still participate in a lawsuit to win back overcharges.

Read article here:

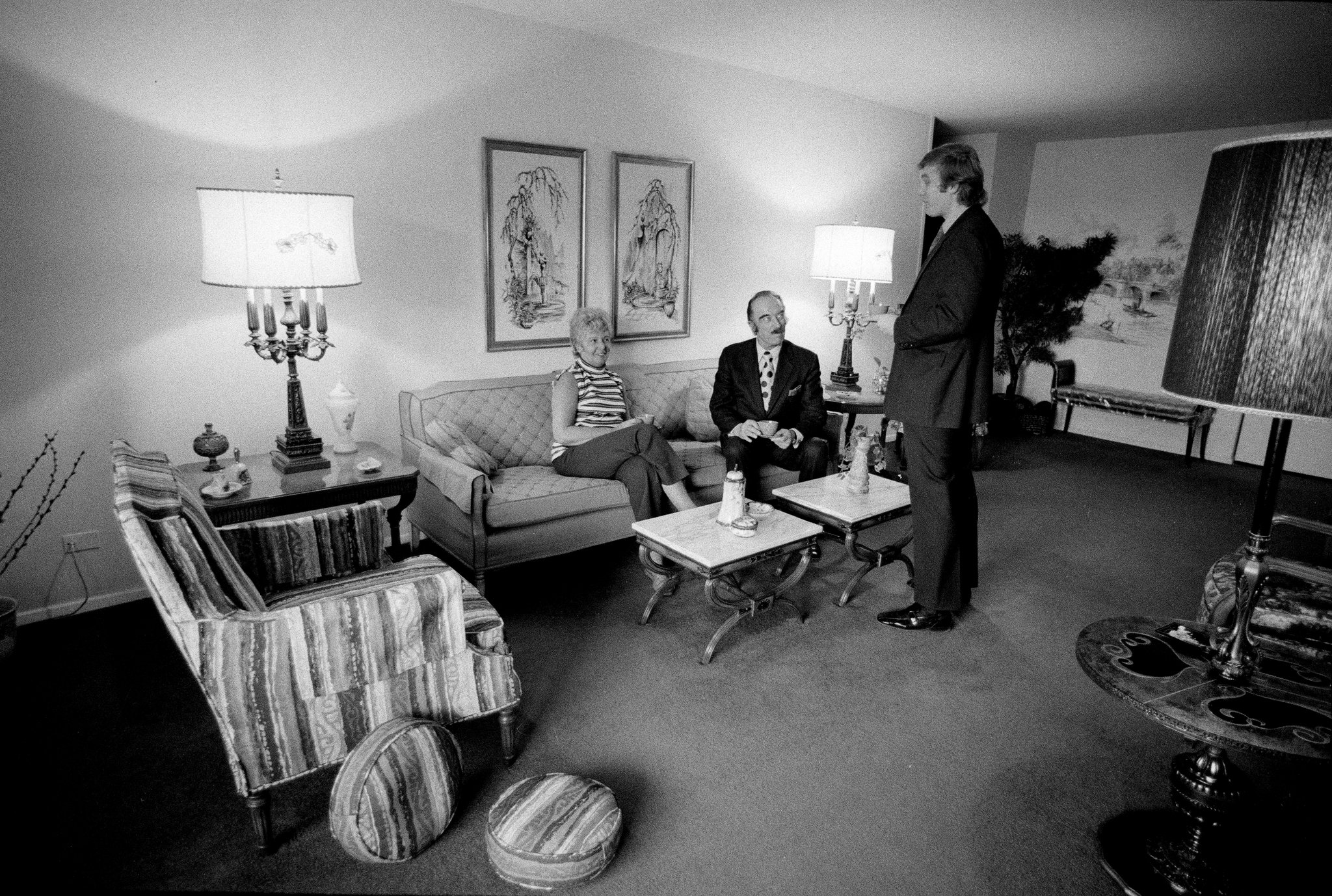

| NYTimes: As the Trumps Dodged Taxes, Their Tenants Paid a Price  Jack Leitner outside the Beach Haven Apartments in Brooklyn. A tax scheme created by the Trumps, who owned the building, artificially inflated rent paid by him and thousands of other tenants.Joshua Bright for The New York Times By Russ Buettner and Susanne Craig Dec. 15, 2018They were collateral damage as Donald J. Trump and his siblings dodged inheritance taxes and gained control of their father’s fortune: thousands of renters in an empire of unassuming red-brick buildings scattered across Brooklyn, Queens and Staten Island. Those buildings have been home to generations of strivers, municipal workers and newly arrived immigrants. When their regulated rents started rising more quickly in the 1990s, many tenants had no idea why. Some heard that the Trump family had spent millions on building improvements, but they remained suspicious. “I’ve always thought there was something strange going on,” said Jack Leitner, who has lived in the Beach Haven Apartments in Coney Island, Brooklyn, for more than two decades. “But you have to have proof, and it’s an uphill battle.” As it turned out, a hidden scam lurked behind the mysterious increases. In October, a New York Times investigation into the origins of Mr. Trump’s wealth revealed, among its findings, that the future president and his siblings set up a phony business to pad the cost of nearly everything their father, the legendary builder Fred C. Trump, purchased for his buildings. The Trump children split that extra money. [Read The Times’s investigation here.] Padding the invoices had a secondary benefit for the Trumps, allowing them to inflate rent increases on their father’s rent-regulated apartments. “The higher the markup would be, the higher the rent that might be charged,” Robert Trump, the president’s brother, once admitted in a sworn deposition obtained by The Times. The president and his siblings have long since sold their father’s buildings and moved on with their inherited fortunes. But for tenants, the insidious effects of the scheme continue to this day.  A phony company that padded invoices to Beach Haven and other properties was used to siphon Fred C. Trump’s wealth to his children.Dave Sanders for The New York Times The padded invoices have been baked into the base rent used to calculate the annual percentage increase approved by the city. The sum total of the rent overcharges cannot be calculated from available records. As a way to appreciate the scope of the impact, a onetime $10 increase in 1995 on all the 8,000 apartments involved would put the total overpaid by tenants at more than $33 million to date, an analysis of approved rent increases shows. Mr. Leitner, a retired computer programmer, was not pleased to learn that his rent had been artificially inflated. Like other tenants interviewed by The Times, he wants that money back. “If they passed on phony costs to tenants, they should lower our rents,” he said. The Times’s investigation of the Trump family’s finances, based on a vast trove of tax returns and confidential financial records, found that Donald Trump, contrary to his lifelong claim of being a self-made billionaire, received the equivalent today of at least $413 million from his father. That fortune was greatly increased by dubious schemes — including instances of outright fraud — designed to dodge gift and estate taxes, the investigation found. Mr. Trump was a central player in the formulation of those strategies, which included grossly undervaluing his father’s apartment complexes in tax filings, interviews and records showed. He also received tens of millions of dollars in gifts from his father that were disguised as loans or business investments. Mr. Trump and his brother Robert did not respond to requests for comment for this article. But in a written statement for The Times’s original piece, one of the president’s lawyers, Charles J. Harder, said that “there was no fraud or tax evasion by anyone,” and that Mr. Trump had delegated tax matters to relatives and tax professionals. The most overt fraud uncovered by The Times involved the sham corporation, All County Building Supply & Maintenance, created by the Trumps in 1992. It appeared, on paper at least, to be a purchasing agent for Fred Trump’s buildings. In reality, the creation of All County did not change how Fred Trump’s business functioned. He and his executives continued to negotiate prices for everything from roofs to window cleaner, but vendors began receiving checks from an All County bank account. Fred Trump’s apartment buildings then reimbursed All County, with an extra 20 to 50 percent tacked on. All County was owned by Donald Trump, his three siblings and a cousin. In some years, the amounts distributed to each Trump sibling ballooned to nearly $1 million, records obtained by The Times show. Because All County performed no real work, the transfer of money through the corporation was essentially a gift that evaded the 55 percent tax in place at the time, tax experts told The Times. Former prosecutors told The Times that the filing of padded invoices with state rent regulators could have led to criminal charges at the time, but that the statute of limitations has long since expired. Civil penalties in cases of fraud remain a possibility, and tax authorities in New York City and New York State have said they are examining issues raised by The Times’s investigation. Lawyers who specialize in representing tenants say the Trumps’ current and former tenants may have an opening to challenge the decades-old increases, potentially rolling back rents and collecting damages. Michael Grinthal, supervising lawyer with the Community Development Project at the Urban Justice Center, a nonprofit legal services and advocacy group, said that the current owners would be held responsible for any damages, but that those owners could have a claim against the president and his siblings. “If I was talking to those tenants right now, I’d say: ‘Do it. Go,’” Mr. Grinthal said. “This case should be fought.” Regulations generally allow tenants to challenge rent for the past four years. But the state’s highest court has held that tenants can look back further to show their landlord increased rent through fraud (though damages are still limited). “If they are making false statements about how much it costs, that would be pretty much dead center of the definition of fraud,” Mr. Grinthal said. Although the state Division of Housing and Community Renewal oversees rent-regulated apartments, the responsibility for uncovering overcharges falls mostly to tenants, many of whom are unaware of the rules. Just trying to figure out the codes on rental history forms and discern what drove up their rent can seem daunting. Susan Shavitz, 73, moved into her two-bedroom at Trump Village in Coney Island with her mother when Fred Trump completed construction in 1964. Decades later, her rent begin to rise more quickly. She believed at the time that the increases were exclusively because the Trumps had switched the building to a different affordable-housing program. Ms. Shavitz obtained her apartment rental history from the state at the request of The Times, but she could not translate the soup of numbers and abbreviations  A portion of Susan Shavitz’s rental history at Trump Village in Brooklyn. The padded invoices still affect rent, as the initial increase was compounded over the years. “It made no sense to me whatsoever,” said Ms. Shavitz, a retired teacher. “I have no idea how much of it was because of the improvements.” Other records show the state approved a building-wide rent increase in 1997 of almost $1.1 million after the Trumps installed new windows, terrace doors and boilers, which were an early focus of the All County purchases. That project increased Ms. Shavitz’s rent by $32 a month. While it is not known how much of that is attributable to All County, the cost of improvements bumped up her rent in five of the last eight years that the Trumps owned the buildings, adding 11 percent in all. Ms. Shavitz said that she was financially comfortable and could afford her rent but would still participate in a lawsuit to win back overcharges. Like Ms. Shavitz and her mother, thousands of tenants once saw moving into a Fred Trump building as a step up the economic ladder, an arrival of sorts. In the postwar era, the president’s father came to own more than 10,000 apartments in New York City, and thousands more elsewhere, often financing the construction through low-interest government loans aimed at creating affordable housing for returning veterans and the booming middle class. The rules attached to those loans kept rents low, but Fred Trump excelled at keeping costs low, and the empire became enormously profitable. In just one six-year span, 1988 through 1993, Fred Trump reported $109.7 million in total income, the equivalent today of $210.7 million, according to confidential tax records obtained by The Times.  Fred Trump and his son Donald visiting a tenant in Brooklyn in 1973.Barton Silverman/The New York Times His buildings share a uniform austerity. Most are six-story brick rectangles with incongruously aristocratic sounding names — Saxony Hall, Westminster Apartments, Green Park Essex. His largest projects were sprawling complexes with acres of lawn in and around Coney Island — Beach Haven, Shore Haven and Trump Village. The folk singer Woody Guthrie took an apartment at Beach Haven in 1950. He wrote a song called “Old Man Trump,” contemplating the morality of paying rent to someone who would not allow blacks to live in the building. The chorus began: Beach Haven ain’t my home!

I just can’t pay this rent! My money’s down the drain! And my soul is badly bent! Mr. Leitner, 69, remembers that when he signed his first lease at Beach Haven in 1996, the rent was significantly higher than the one quoted during his apartment hunt. He recently obtained the official rental history of his apartment from the state at the request of The Times. It shows that his initial rent was $728, an increase of $154 from the prior tenant’s rate. Most of that jump, in fact, was because of the improvement costs. The effect of those costs was compounded through the years, as every approved rent increase built upon the starting point. And while some portion was certainly legitimate, even a $10-a-month increase because of a padded All County invoice would mean that Mr. Leitner had given his landlords at least $3,800 more than they were legally entitled to over the past 22 years. Housing advocates have long argued that there is widespread abuse of the two programs that owners of rent-regulated apartments use to raise rents based on improvements or repairs. Two Albany lawmakers introduced legislation last August that would end one, known as Major Capital Improvements. “The M.C.I. program has been subject to abuse by landlords for years — the fact the Trump family did it just highlights that,” said one of the lawmakers, state Senator Michael N. Gianaris, a Queens Democrat. “It’s time to scrap the program.” Because the increases carry forward, even tenants who moved in years after the Trumps sold the last of their father’s empire in 2004 were affected by the family’s invoice-padding scheme.  Angel Castillo on the day he moved out of his unit at Beach Haven. His current landlord raised his rent by $150 a month.Joshua Bright for The New York Times “I want it looked at because a lot of tenants may be owed money,” said Angel Castillo, 49, who moved into Beach Haven a few years after the Trump siblings sold it. He moved out just a few weeks ago. The reason: The current landlord increased his rent by $150 a month. “They told me I was lucky it wasn’t more,” he said. |

| You can read further at | The Problem |

| You can read further at | Guide to "Checks and Balances" |

| You can read further at | The Solution |

| Write us at | letters@thechristiansolution.com |

Article located at:

http://www.thechristiansolution.com/doc2019/907_FredTrump.html

Last Hope for America

Christian Libertarian: Harmonious Union

of

Church and State

Christian Libertarian: Harmonious Union

of

Church and State

Must Read Classics

Problem

"Checks and Balances"

Solution

Complete

Political

Spectrum

Holocaust

Fraud

Jewish

Final

Solution

Progressive

Tale

Chosen

People

History of the World

Part 1

Part 2

Part 3

Part 4

Part 5

Part 6

Jewish

Century

Great

Sanhedrin

Four

Diasporas

Four

Diasporas

Jewish

Apartheid

media-Scribe

FRAUD

The Christian Solution © First Release: March 15, 2008