February 24, 2009

Fed-up with the Fed

Source: Chris Martenson

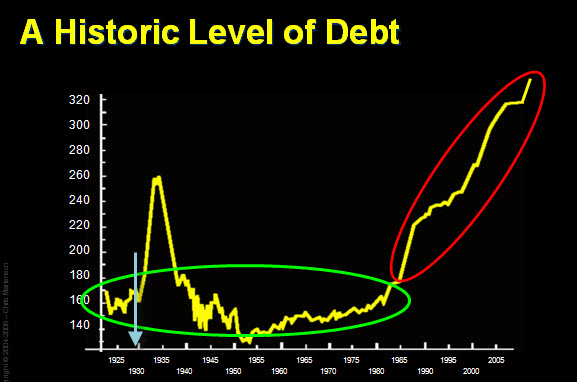

The crisis explained in one chart: Debt-to-GDP

Source: WND

TOSSING OUT THE MONEY CHANGERS

Historic Chart of the Ratio of "Debt-to-GDP"

In the chart above depicting a ratio of debt-to-GDP, the Great Depression did not see debt rise, instead it saw the GDP fall. Hence, the rise seen in the chart, after the 1929 stock market crash, was not banks loaning out more money to create more debt, but was instead caused by the contraction of the economy. We had almost the same debt, but we had less GDP (Gross Domestic Product), hence the ratio shot skywards.

Always since then, the debt was kept below 200% of GDP. In other words, if your income is $50,000 per year, you can afford to buy a house valued at twice that, or $100,000 per year, but not higher. Same principle happens in aggregate (on average).

Starting in 1985, during the Reagan years, we shot past the 200% mark and we have not looked back since then.

While Reagan piled on debt to raise the debt side of the Debt-to-GDP ratio, Clinton worked the other end -- He reduced GDP side of the equation, by exporting our GDP to China and India.

In the Internet bubble crash in 2000, we had reached the historic Great Depression levels, but government kept printing money, creating more debt, while at the same time, allowing more GDP to leave the country to China.

If our remaining GDP goes down the way of the Great Depression, that is, in a serious depression, then the Debt-to-GDP levels could surpass the 500% to 600% levels.

We are technically bankrupt, as we cannot repay the debt.

We cannot inflate our way out of the problem, as it creates yet more debt.

We can try to get our GDP back from China, but China will not sell us back our manufacturing equipment, as we cannot afford to buy it back from them. Besides, they will not want to give up what we have given them.

The only thing we can do is to repudiate the debt. And if we do that, China and Saudi Arabia will certainly cut us off.

In summation, we are at twice the Great Depression levels of debt/GDP and at a time where few know how to raise vegetables or few know how to can food.

Like WW2 was far worst than WW1 -- so will GD2 be far worst than GD1.

Americans do indeed understand who is behind our problems, but are powerless to do anything about it

Do our Jewish media-Scribes ever report that the majority of "thinking" Americans are:

What do you think of Ron Paul's call to abolish the Federal Reserve?

(3884 votes)

| We have nearly 100 years of experience proving that the Fed destroys the fruit of our hard work, savings and investment - it's time to shut it down | 50% (1950) | |

| The Federal Reserve is unconstitutional - that's reason enough to abolish it | 18% (698) | |

| I agree with Paul - at the root of every financial crisis over the past century is Fed policy | 14% (537) | |

| We need money that has consistent value - when's the last time government had to bail out gold? | 7% (267) | |

| It's the only way to stop the inevitable inflation that's going to follow from Obama's spending policies | 2% (82) | |

| I'm thinking maybe I should have voted for Ron Paul instead of what's-his-name | 2% (65) | |

| I know the Constitution grants these powers to Congress, but with the bunch we have now, perhaps leaving the Fed in charge is better | 2% (61) | |

| I'd rather my elected representative have a voice in setting the nation's monetary policy than some faceless foreign banker with no loyalty to America | 2% (61) | |

| Ron Paul is a nut who knows nothing about how a complex modern economy works | 1% (30) | |

| We had booms and busts, prosperity and poverty before there was a Federal Reserve - abolishing it is no panacea | 1% (30) | |

| Ron Paul is well-meaning but ineffective ... like Don Quixote tilting at windmills | 1% (28) | |

| Even if there are problems with the Federal Reserve, abolishing it in the middle of this crisis doesn't seem wise | 1% (27) | |

| Other | 1% (27) | |

| He introduces this bill every session and he has no co-sponsors - enough said | 0% (8) | |

| Paul blames every problem in the economy on Federal Reserve policy - that sounds like he's overstating it to me | 0% (7) | |

| The Fed is the source of stability in our economy, restoring order when crooked bankers, Wall Street hustlers and greedy oil sheiks throw everything into chaos | 0% (6) | |

Article located at:

http://thechristiansolution.com/doc2009/136_DebttoGDP.html

Last Hope for America

Christian Libertarian: Harmonious Union

of

Church and State

Christian Libertarian: Harmonious Union

of

Church and State

The Christian Solution © First Release: March 15, 2008